Freight Forwarder Insights

Huin International Logistics Latest Articles

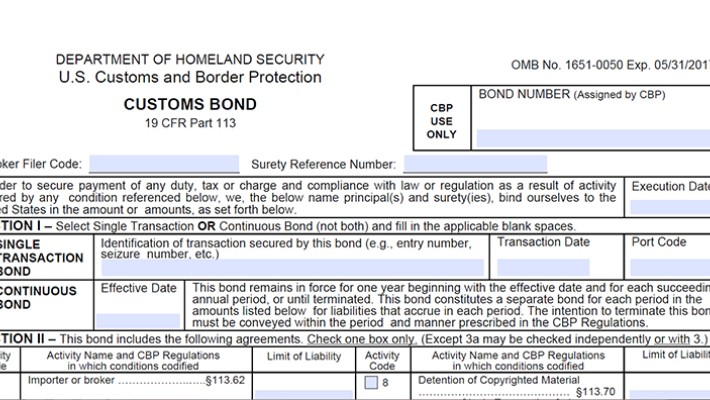

CUSTOMS BOND

What is a Customs Bond?

It's a contract between the importer, customs, and a third party to ensure all duties are paid to Customs.

"Only the United States requires it for importing goods into the country!"

Do you need a Customs Bond?

You only need to get a bond if:

- The value of your imported goods is greater than $2,000

- You are importing textiles worth more than $250

- You have to meet federal regulations for products such as firearms or food

There are 2 types of Customs Bond:

- Single Entry Bonds, for a per shipment basis

- Continuous Bonds, which are valid for a year

Single Entry Bond :

How much does a Customs Bond cost?

A single entry bond is usually calculated at $5.50 per $1000 of the Bond Amount, or a $55.00 minimum fee.

Single Entry Bond = (Bond Amount) / $1000 * $5.5

Bond Amount = Total Declared Value + Duties & Taxes

Continuous Bond:

Simple Scenario Time:

Total Declared Value = US $30,000

Duties and Taxes = US $170

Bond Amount = US $30,000 + $170 = $ 30,170

Single Entry Bond Cost = ($ 30,170) / $1000 * $5.5 = ~$166

To be eligible for a Continuous Bond, the Bond Amount needs to be minimum

$50,000.

The Bond price is then $475 per year.

Continuous Bonds are valid for only one year, and every renewal will cost you $475.