Freight Forwarder Insights

Huin International Logistics Latest Articles

CARRIAGE & INSURANCE PAID TO INCOTERM (CIP)

What is Carriage & Insurance Paid to (CIP)?

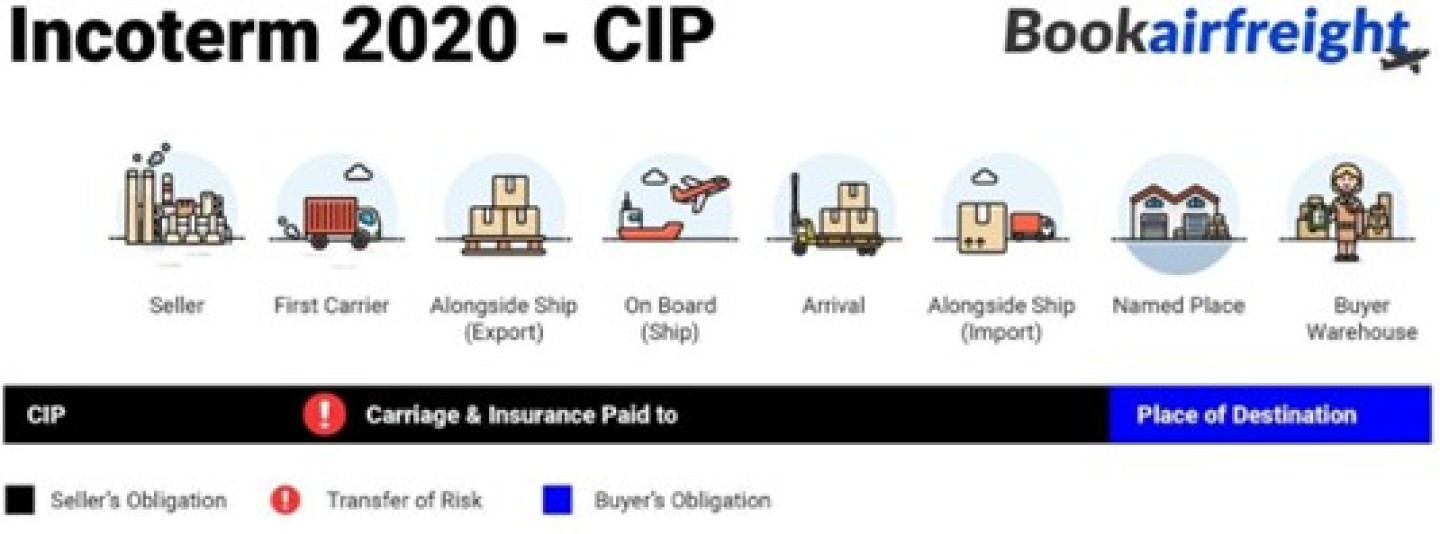

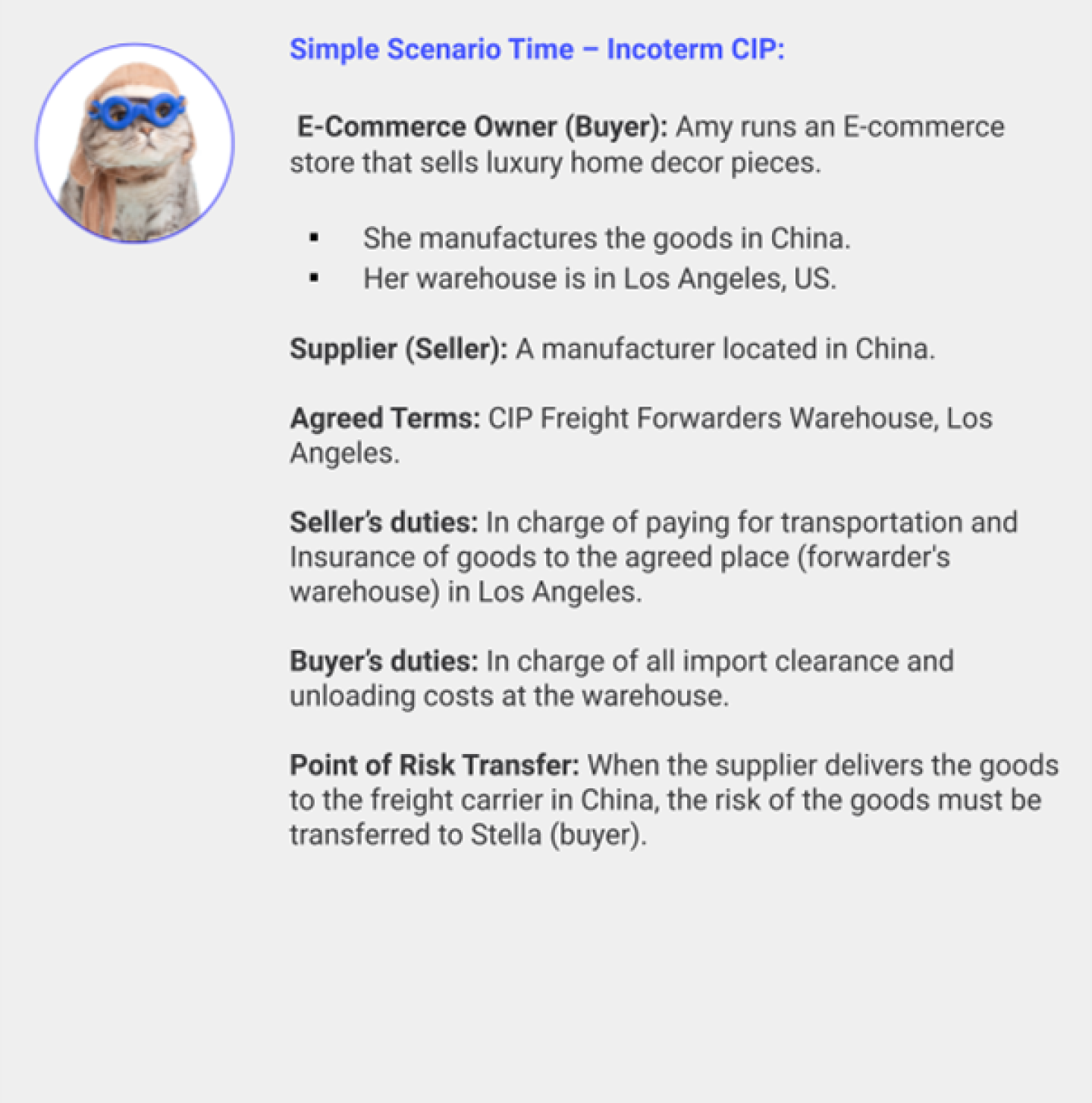

CIP is one of the 11 International Commercial Terms (Incoterms) used in trade, where the seller is required to:

- Arrange and pay for insurance of the goods in transit. Under CIP, the seller is obligated to insure goods in transit for 110% of the contract value.

- Arrange and pay for transportation costs from the factory to the agreed place (named place).

Point of Risk Transfer!

When the seller delivers the goods to the first carrier, the seller no longer guarantees that the goods will arrive at the agreed place in good condition. At that point, the risk of the goods getting lost or damaged is transferred to the buyer.

When should you choose CIP?

CIP is most commonly used for manufactured goods with higher value, because the seller is responsible for the entire transportation process, including insurance.

Cost allocation – who should pay what under CIP:

How much insurance should the seller cover?

Under CIP, the sellers are legally required to insure the goods for 110% of the Total Declared Value.

Some buyers may feel that 110% coverage is not enough protection. If so, buyers can take it up with the seller and ask for more coverage.

What is the difference between CIP and CPT?

The only difference is insurance!

- Under CIP, the seller is legally obligated to buy insurance for the goods at 110% of their value.

- Under CPT, there is no legal obligation to buy insurance but the buyer purchase it if they wish to.