Freight Forwarder Insights

Huin International Logistics Latest Articles

Understanding HS Codes in Shipping: How They Work and Their Importance

What Are HS Codes?

HS Codes, short for Harmonized System Codes, are part of an internationally standardized system called the Harmonized Commodity Description and Coding System. Established to uniformly classify globally traded products, this system operates under the auspices of the World Customs Organization (WCO). Initiated in 1988 after the signing of the HS Convention in 1983, it now boasts the participation of over 205 countries.

The Purpose of HS Codes

The primary goal of HS Codes is to streamline global trade by providing a consistent method of classifying various goods. Each member country that adheres to the Convention agrees to structure their tariff codes and duty architecture in alignment with the HS Code classifications. The system simplifies international commerce by facilitating the clear identification of traded goods, thereby promoting efficiency and reducing potential legal and bureaucratic complications.

What Exactly is an HS Code?

An HS Code is a numerical classification system developed and maintained by the WCO. These codes, which vary in length from 6 to 10 digits, are mandated for all international shipments. Recognized globally, these codes are integral to customs procedures, ensuring that shipments clear local authorities smoothly.

Applications of HS Codes

HS Codes serve a wide array of functions, including but not limited to:

- Transport tariffs and statistical analysis

- Collection of domestic and international taxes

- Regulation and monitoring of controlled goods

- Imposition of customs tariffs

- Compilation of trade statistics

- Determination of rules of origin for products

- Facilitation of trade negotiations

- Risk assessment and compliance in information technology

Many businesses also leverage HS Codes to calculate the overall landed cost of imported items and identify market opportunities.

Structure of an HS Code

Typically composed of six digits, HS Codes can extend further to provide more detailed information:

- The first two digits represent the product category

- The next four digits add specificity to the type of product and its materials

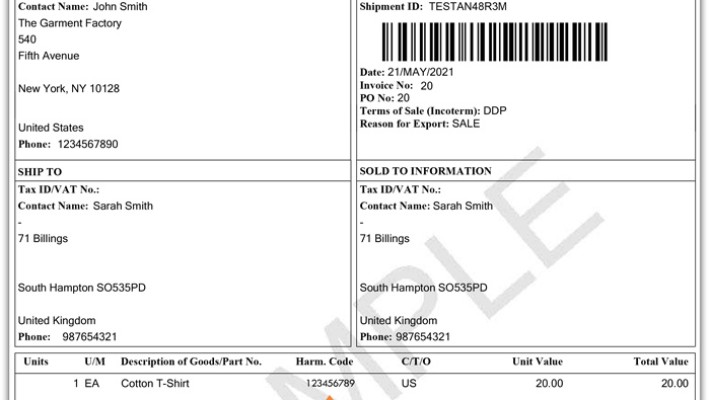

For instance, the code for cotton T-shirts is 61091000. Here, '61' denotes knitted clothing, '6109' specifies knitted shirts and vests, and '610910' indicates that the material is cotton.

Importance of HS Codes

HS Codes play a pivotal role in the global trading ecosystem:

- They provide an internationally recognized identifier for products during exportation

- They are crucial for calculating duties and taxes during customs clearance

- They help gather data on import and export activities

How to Find Your HS Code

Identifying the correct HS Code for your products involves a few straightforward steps:

- Visit the Directorate General of Foreign Trade (DGFT) website

- Search the HS Code list provided by the Ministry of Commerce

- Locate the relevant chapter for your product

- Identify the correct heading, subheading, and tariff item

- Select the appropriate HS Code for your product

How Do HS Codes Function?

The HS Code system uses a standardized 6-digit number for global classification, encompassing 5,300 product descriptions. Ideally, each product should be classified similarly by all countries using the system. However, discrepancies can arise due to variations in rule application, version differences, product complexity, historical rulings, and expertise gaps.

Utilizing HS Codes in Trade

To utilize HS Codes effectively, follow these steps:

- Partition your product range into specific categories for better management and data integrity

- Conduct thorough research to remain updated on regulatory changes and rulings

- Gather detailed product specifications to assign the most accurate classification

Are HS Codes Uniform Worldwide?

The initial six digits of an HS Code (or HTS Code) remain consistent across all countries. However, individual nations may append additional digits to offer more detailed classifications without altering the base code.

How Can HUIN Assist You?

At HUIN Logistics, our team of customs and trade compliance experts stays current with all regulatory activities. We can help identify risks, optimize your classifications, and exploit available benefits like legitimate re-classifications, reduced duty rates, and duty suspensions.

Ready with Your Code? Contact us for further assistance.