Freight Forwarder Insights

Huin International Logistics Latest Articles

What is A Customs Bond? What Types and Where to Buy?

Understanding customs bonds is essential for smooth importation processes in international trade shipping. This article will show the concept of customs bonds, their requirements, types, and how to obtain them.

What is a customs bond?

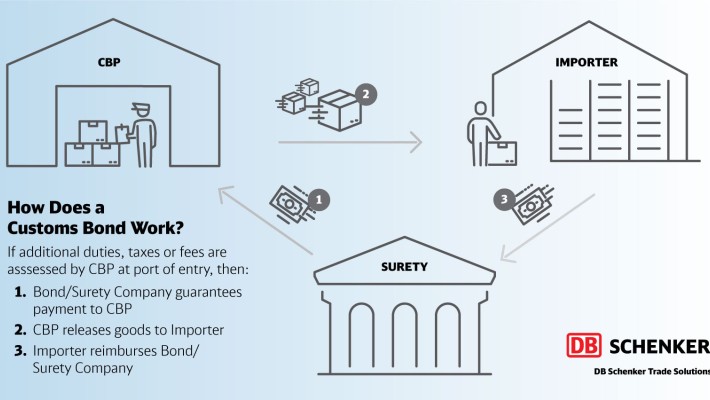

A customs bond is a financial guarantee required by customs authorities when importing goods into a country. It serves as a commitment from an importer or their authorized agent to comply with all customs regulations, including paying duties, taxes, and fees and adhering to importation laws.

The customs bond ensures that the government will be reimbursed if the importer fails to fulfill their obligations or if any violations occur during the importation process. In essence, a customs bond acts as a safeguard for customs authorities, providing assurance that the importer will fulfill their responsibilities as a lawful participant in international trade.

When is a customs bond required?

The specific requirements may vary depending on the country’s customs regulations and the type of imported goods.

In the context of importing to USA, a customs bond will charge under the following circumstances:

1. Paying customs bonds is mandatory for commercial shipments valued at over $2,500 when entering the United States. It includes goods intended for resale, commercial use, or further manufacturing.

2. Even if the value of the goods is below $2,500, customs authorities may require a bond for high-value shipments to ensure compliance with customs regulations.

3. When importing dutiable goods subject to customs duties, taxes, and fees, it is generally necessary to guarantee payment by a customs bond.

4. Certain goods, such as alcohol, tobacco, firearms, and other controlled items, may require a customs bond to ensure compliance with specific regulatory requirements.

5. Businesses that frequently import goods may opt for a continuous bond, which covers multiple shipments over a year, simplifying the importation process for regular transactions.

What are the consequences of not getting a bond?

The customs authorities may hold your imported goods at the port of entry until provided a valid customs bond when failing to obtain it. It can cause delays in goods’ movement to their intended destination, resulting in potential losses for the importer and disruptions in supply chains.

In more severe cases, customs authorities may seize and confiscate the imported goods if a customs bond is not provided. It can result in significant financial losses for the importer, especially if the goods are valuable or perishable.

How to determine your customs bond amount?

The customs bond amount is calculated based on the value of the imported goods, the applicable duties and taxes, and any additional fees determined by customs. To determine the customs bond amount, follow these steps:

Step 1# Calculate duties and taxes

Start by calculating the duties and taxes applicable to the imported goods. Check the Harmonized Tariff Schedule (HTS) or the customs website of the importing country to find the applicable tariff rates.

Step 2# Include other fees

These can include customs processing fees, inspection fees, handling charges, and storage fees. Factor in all potential expenses to ensure the bond amount adequately covers these costs.

Step 3# Identify the customs bond type

Decide whether a single-entry Bond or a continuous bond is more suitable for your importation needs. For regular importers, a continuous bond is often more cost-effective.

Step 4# Calculate the bond amount

To calculate the amount for a single-entry bond, you should add the duties, taxes, and other fees for the specific shipment. For a continuous bond, determine the cumulative value of multiple imported shipments within the bond’s validity period. Add all the duties, taxes, and fees for these shipments to arrive at the total bond amount.

For complex imports or high-value goods, you better seek assistance from customs brokers or import specialists. For example, HUIN International Logistics, a senior freight forwarder, can provide valuable insights. They can ensure that the bond amount is accurately calculated to meet all customs requirements.

Where to buy a customs bond?

Generally, you can buy it from surety companies or insurance companies that are authorized by the destination country’s customs authorities. For instance, the U.S. Customs and Border Protection (CBP) maintains a list of approved surety companies on its website. You can choose from these authorized companies to obtain their customs bonds if shipping to USA.

What should you consider when purchasing it?

Financial standing of the surety company: Verify that the surety company has the financial capacity to issue the required customs bond. It is essential to ensure that the selected surety company has a good track record of providing reliable customs bonds.

Bond coverage: Ensure that the customs bond covers the specific type and value of imported cargo.

Prompt Issuance: Look for a surety company that can promptly issue the customs bond, as delays in obtaining the bond may cause shipment hold-ups.

Competitive rates: Compare the rates and fees offered by different surety companies to find the best deal for the customs bond.

Working with a reputable customs broker or freight forwarder can also be beneficial when obtaining a customs bond. These professionals have experience in dealing with customs requirements and can assist you in securing the appropriate customs bond efficiently.

What are the types of customs bonds?

There are two common classifications of customs bonds in international trade: Single Entry Bonds and Continuous Bonds.

What is a single-entry bond?

A single entry bond is a type of customs bond that covers a specific import shipment. It is a one-time bond that provides a financial guarantee to customs authorities for a single import transaction.

Once the imported goods covered by the single-entry bond have fulfilled customs requirements, the bond is considered satisfied and is no longer valid for future shipments.

For infrequent or occasional importers who do not engage in regular shipments, a single entry bond can be a practical and cost-effective option, as it covers individual transactions without the need for an ongoing commitment.

What is a continuous bond?

A continuous bond, also known as an annual bond, provides coverage for multiple import shipments within a specified period(usually one year). Unlike a single entry bond, a continuous bond remains in effect for the entire year. It allows you to conduct multiple imports without obtaining separate bonds for each transaction.

The continuous bond streamlines the importation process for regular importers who engage in frequent shipments. It eliminates the administrative burden of obtaining a new bond for each import transaction, saving time and effort for the importer and facilitating a smoother importation experience.

What are their fees and costs?

Customs authorities calculate the continuous bond cost by a percentage of the total duties, taxes, and fees the importer is expected to pay throughout the year. This percentage can range from 10% to 110% of the estimated annual importation costs based on different factors.

As for the single entry bond fees, the cost can vary depending on the value and the type of goods or the country’s customs regulations. The bond amount is usually a percentage of the total value of the imported goods, and the fee typically depends on this amount.

You can obtain the exact fees from surety companies or customs brokers authorized to issue the bonds. It is essential to shop around and compare the rates offered by different surety companies to find the best deal for their specific importation needs. Want to get the most competitive price? Get a live quote from HUIN International Logistics Group now!

Leverage the experience of the HUIN

Importers must carefully assess their needs, choose the appropriate bond type, and acquire it through an approved surety company. Working with a top freight carrier can secure your customs bond hassle-free.

HUIN experts will connect you with reputable surety companies authorized by customs authorities to issue customs bonds. In addition, HUIN International Logistics can expedite the bond application and approval process, saving you time and effort. With their guidance, ensure your customs bond fully complies with all customs regulations, providing security for your importation journey. Don’t hesitate and contact the HUIN team now!